Perfecting Your Exit Strategy: A Case Study

Author: Larry Chester, President

Every business owner knows he’s going to leave his business eventually, but how a business owner does so, is a great indication of their leadership.

Today, we have Larry Chester, President of CFO Simplified, presenting a case study on succession planning. He’ll use this case study to discuss the challenges of succession planning, as well as how to avoid these challenges, and train your successor.

Let’s dive in.

Leaving Your Business is Inevitable

Every business owner knows they are going to leave their business eventually—and many entrepreneurs have the desire to pass their business on to their children. This method of succession planning is a wonderful way of keeping family generational wealth growing.

The difficulty, however, is that you have to plan for it.

Below, we’ll introduce a case study that stands as a cautionary tale.

A Father-Son Case Study

This case study sets a story of a father who had received the business from his father and was then passing it on to his son.

The difficulty was that they faced a number of problems.

- The son was inexperienced as far as running a business goes. (He had experience in engineering).

- The company was facing cash flow issues.

- The business was having difficulty with its bank.

Despite all of these challenges, the son had great aspirations to significantly grow the family business. So, how can you avoid these problems in making the decisions to pass your business on? Let’s discuss.

How Can You Avoid These Challenges?

First, let’s talk about planning for your succession.

Unfortunately, succession planning is not something you can do in a matter of weeks or months. When large companies hire star performers to grow into management roles in their businesses, it can take years to train these individuals—to be equipped to take over the business, that is.

And how do they train these star performers?

By giving them experience in multiple places within the business.

Larry Chester, President of CFO Simplified, has watched large companies successfully plant star performers for one year in operations, then a year in sales, then in finance, human resources, and then in legal.

With experience in all of those areas, they know enough about how the business operates to be able to grow themselves and help the business succeed.

Are You Passing on Your Business?

If you’re planning to pass your business down to your child, you should do nothing less in training them to be able to take over.

Most business owners will teach their children one of two things first; either business operations or sales. Many times after this, they feel their child has enough experience in those areas to grow the business and take over as owner.

The reality, however, is that without an understanding of finance, human resources, and the legal aspects of running a business as well, the child really only has a small part of the arsenal they need to move forward.

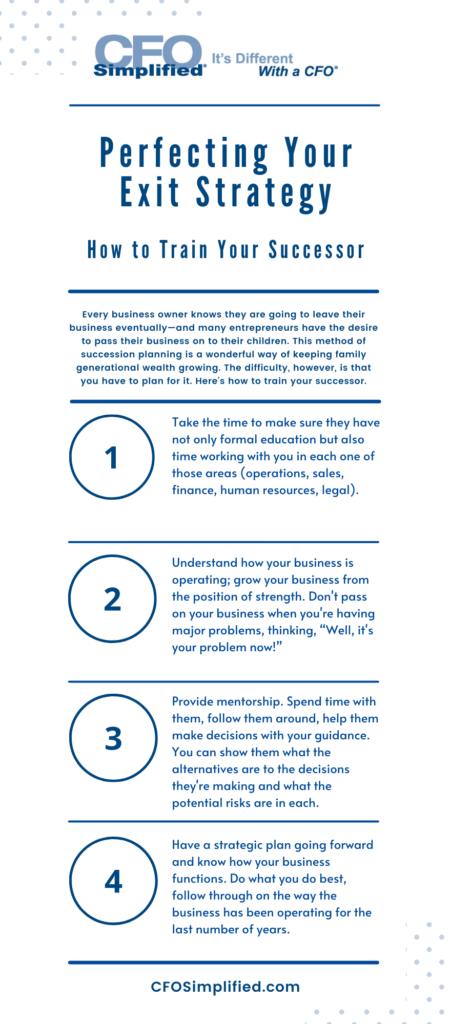

How to Train Your Successor

How to Train Your Successor

First things first, take the time to make sure they have not only formal education but also time working with you in each one of those areas (operations, sales, finance, human resources, legal).

This way, you can guide your successor by showing them how you’ve done things in the past.

Secondly, make sure they understand how your business is operating; grow your business from the position of strength. Don’t give your children the business to take over when you’re having major problems, thinking, “Well, it’s your problem now!”

Instead, what you want to do is give them a business that has:

- Strong cash flow

- Solid sales

- A good banking relationship

- Good customer relationships

This way, your successor can make small changes to how the business is already operating.

Third, provide mentorship for your successor. Don’t be in a position like our case study business owner, where he tossed the keys to his son and said, “Give me a call if you have any problems.”

Spend time with them, follow them around, help them make decisions with your guidance. You can show them what the alternatives are to the decisions they’re making and what the potential risks are in each one of those.

Have those discussions with them.

Lastly, have a strategic plan going forward and know how your business functions. Moving forward, plan on making small steps if your child wants to make changes in how the business is operating. Do what you do best, follow through on the way the business has been operating for the last number of years.

Interested in learning more about succession planning? Read on in “Succession Planning: Preparing to Exit Your Business.”

Related Posts

Succession Planning Creates Transition Success

Throughout 2022, trends such as the Great Recession and Quiet Quitting were rampant. In 2023, retaining top talent and planning

Your Inventory Value Report

If you're like most business owners, you probably don't give much thought to your inventory value report. After all, what's

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.