How a CFO Can Help Sell Your Business

Author: Larry Chester, President

How a CFO Can Help Sell Your Business

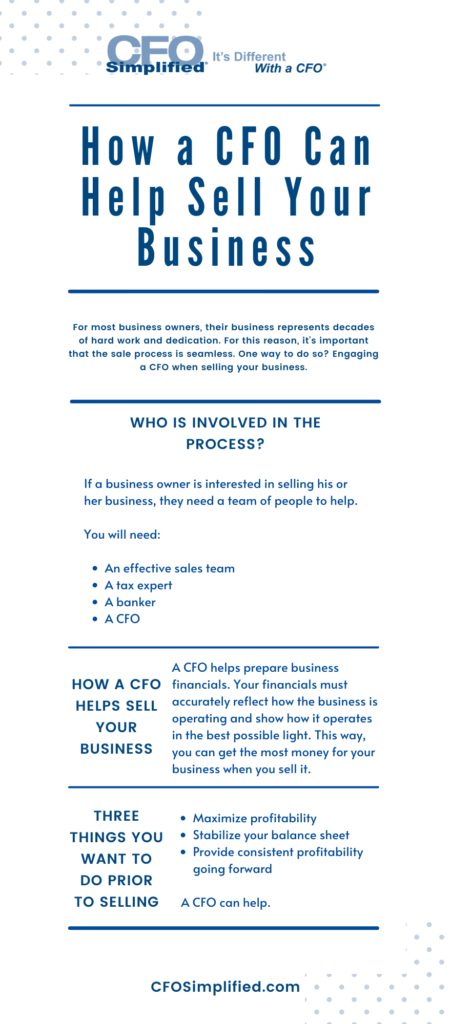

For many business owners, selling their business goes a lot deeper than just a transaction. For most, their business represents decades of hard work and dedication. For this reason, it’s important that the sale process is seamless. One way to do so? Engaging a CFO when selling your business.

In the video below, hear from Larry Chester, President of CFO Simplified, as he provides insight into how a CFO can support the sale of your business.

Who is Involved in the Process?

If a business owner is interested in selling his or her business, they need a team of people to help do that.

Think: There is no single person who has all the knowledge necessary to give you every single piece of information you need to be able to sell your business effectively.

This considered, there are various roles you need to consider filling prior to selling your business. Below we’ve noted a few.

You will need:

- A sales team: This is your investment banker whose job is to identify either a financial or a strategic buyer who is interested in buying your business.

- A tax expert: You will need someone to give you tax advice on what the best vehicle is to be able to sell your business.

- A banker: Their role is to find and help you discuss where funding may allow you to be able to sell your business properly.

Last, but most importantly, you need a CFO.

How a CFO Helps Sell Your Business

You need a CFO to help put your business financials together.

Financials

Your financials must accurately reflect how the business is operating and show that it operates in the best light. This way, you can get the best money for your business when you sell it.

And what does the best money mean? The best money means a multiple.

Depending on how your business is structured and what your profitability is, you will receive some multiple on EBITDA (earnings before interest, taxes, depreciation, and amortization).

EBITDA is defined as “a measure of a company’s overall financial performance and is used as an alternative to net income in some circumstances.”

Some multiple of EBITDA is what you’re going to be paid for your business.

If you hire a fractional CFO to help guide your business during this time, chances are they’ve been doing monthly assessments of your transaction readiness. This readiness report should cover all important areas of your business: legal, finance, HR, intellectual property, etc.

Beyond the Numbers

It’s important to note that your CFO’s role is about more than just the numbers. They need to be able to understand the pulse of your business as a whole.

As mentioned, they must consider the team that’s needed to execute the sale, target buyers, and the timing of the potential sale. Your CFO also plays a key role in the execution of the transaction; meaning supporting due diligence, liability and risk assessment, and deal terms.

Depending on the type of sale you’re looking for, your CFO may have varying responsibilities.

A Final Word

Prior to selling your business, there are three things you want to do as a business owner:

- Maximize profitability

- Stabilize your balance sheet

- Provide consistent profitability going forward

A CFO can help achieve these three goals. He or she will also work as a coordinator between the investment banker, your bank, your strategic buyers, your tax attorney, and whoever else you’re working with as that advisory team to help you sell your business.

All this considered, a CFO is a key person for any business owner to use, especially when they’re interested in selling their business.

Interested in learning more about exit planning? Read on for eight ways to craft a successful business exit strategy.

Related Posts

Succession Planning Creates Transition Success

Throughout 2022, trends such as the Great Recession and Quiet Quitting were rampant. In 2023, retaining top talent and planning

Your Inventory Value Report

If you're like most business owners, you probably don't give much thought to your inventory value report. After all, what's

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.