CFO vs Controller – What’s the Difference?

Author: Larry Chester, President

Some small business owners have CFOs working for them. The owner is likely proud that they have prepared their company for the next great leap forward through their strategic staffing decision.

It’s not unusual in a small company for the accounting manager to become the controller and then become the CFO. But without the requisite education, mindset, and experience, just having more years on the job doesn’t prepare the person for that role.

Let’s look at these two roles: CFO vs. Controller: What’s the difference?

What is a Controller? And What Do They Do?

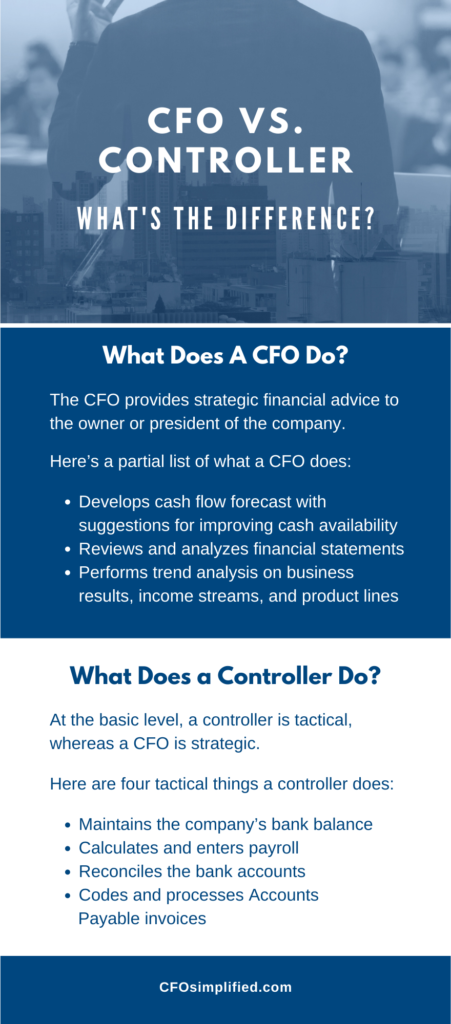

At the basic level, a controller is tactical, whereas a CFO is strategic.

But what does this mean in a practical sense? Here’s a list of ten tactical things that a controller does:

- Maintains the company’s bank balance

- Calculates and enters payroll

- Reconciles the bank accounts

- Codes and processes Accounts Payable invoices

- Issues Accounts Payable checks

- Provides reporting to banks

- Responsible for AR Collections

- Prepares monthly sales tax returns

- Creates journal entries and performs the monthly close

- Produces monthly financial statements

What is a CFO? And What Do They Do?

If the controller does all that, what’s left for the CFO to do? There’s plenty.

The CFO provides strategic financial advice to the owner or president of the company. He prepares information for the owner so that he can make decisions today that will affect their company’s profitability tomorrow.

Here’s a partial list of what a CFO does:

- Develops a cash flow forecast with suggestions for improving cash availability

- Reviews financial statements and evaluates changes

- Performs trend analysis on the company’s business, income streams, and product lines

- Develops dashboards for senior management

- Identifies key performance indicators (KPIs) specific to the market that the company operates in

- Strategically evaluates acquisitions and divestitures

- Maintains and develops the banking relationship

- Risk Management: Is insurance coverage sufficient to provide the needed protection at a reasonable cost?

- Evaluation of revenue streams, business segments for growth, shrinkage, and strategic changes

- Evaluation of inventory: Determination of stocking levels and selection of obsolete inventory with disposal options

- Evaluation of manufacturing costs to identify opportunities for cost savings or abnormalities

If your “CFO” is mired down in the tactical issues facing your company, maybe it’s time to take a look at having a focused CFO help you with the critical strategic issues facing your company.

Consider if you are getting the information that you need to take your company to the next level; then, read on to find out if your business is ready for a part-time CFO.

Related Posts

Developing A Strategic Total Rewards Approach

All companies face the challenge of attracting and retaining good talent and appealing to an employee population that is diverse

What to Know About the Corporate Transparency Act

Effective January 1, 2024, the Corporate Transparency Act (CTA) requires approximately 32 million existing corporations, limited liability companies, and other

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.