The Cash Gap: How Big is Your Gap?

Author: Larry Chester, President

Like many professionals, I try to leave my work at the office to make my personal time free of work-related concerns. However, one particular “business” topic that occasionally comes up, especially during the holidays, is our family’s “cash gap.”

The cash gap is the number of days between when we spend money buying presents, and when I get paid next. You can see why this is important to me!

Just like in my home, an understanding of the cash gap is absolutely critical for your business. For small businesses, understanding your cash gap is a particularly important part of what you need to know to properly fund your company and operate profitably.

What is the Cash Gap?

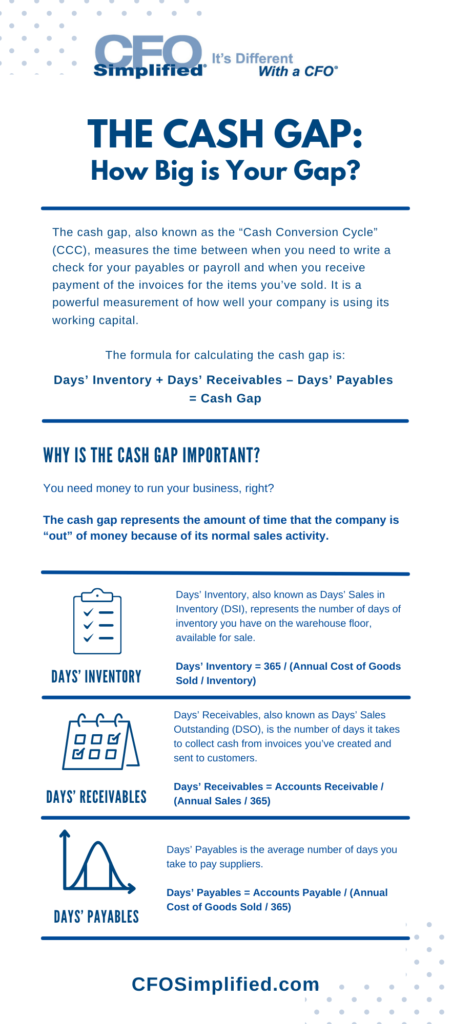

The cash gap, also known as the “Cash Conversion Cycle” (CCC), measures the time between when you need to write a check for your payables or payroll and when you receive payment of the invoices for the items you’ve sold. It is a powerful measurement of how well your company is using its working capital.

The formula for calculating the cash gap is:

Days’ Inventory + Days’ Receivables – Days’ Payables = Cash Gap

Each piece of the above formula is determined by the following calculations:

Days’ Inventory

Days’ Inventory, also known as Days’ Sales in Inventory (DSI), represents the number of days of inventory you have on the warehouse floor, available for sale.

Days’ Inventory = 365 / (Annual Cost of Goods Sold / Inventory)

Days’ Receivables

Days’ Receivables, also known as Days’ Sales Outstanding (DSO), is the number of days that it takes to collect the cash from the invoices that you’ve created and sent to customers.

Days’ Receivables = Accounts Receivable / (Annual Sales / 365)

Days’ Payables

Days’ Payables is the average number of days you take to pay suppliers.

Days’ Payables = Accounts Payable / (Annual Cost of Goods Sold / 365)

*Please note the above calculations are based on a full year. Some companies use monthly or quarterly calculations to account for business cycles, seasonality, industry, etc. It is important to make sure all factors in the calculations are using consistent time periods. Using numbers from several different time periods in the same equation will lead to inaccurate results.

Why Is the Cash Gap So Important?

You need money to run your business, right? If you don’t pay your staff on time, your employees may decide to not come to work tomorrow. If you don’t pay your suppliers on time, they may decide to not ship you critical inventory items.

It represents the amount of time that the company is “out” of money because of its normal sales activity.

When the company is out of money, it must find it from other sources in order to continue operating. In other words, the cash gap is a financial shortfall that the company must fill using other sources of money, like short-term borrowing.

And, as you already know, all money carries a cost, just like interest expense on a line of credit or the opportunity cost of funds that could be used for other purposes. As a result, an excessive or poorly managed cash gap leads to extra costs and may have a significant negative effect on profitability and cash flows, while at the same time undermining a company’s ability to grow.

The cash gap, specifically, is expressed as a number of days. However, its impact is felt in real dollars, including interest, which the company has “tied up” in working capital.

Because of this, understanding your company’s cash gap is an important part of many decisions that must be made when operating your business, including:

- Determining the proper size and terms of a short-term line of credit with your bank: The longer your cash gap, the more you will need to borrow to cover it, and vice versa.

- Pricing and profitability: The cost of your cash gap acts the same as the cost of materials and labor and must be understood as part of pricing and profitability decisions.

- Customer and Supplier relationships: These obviously have a direct impact on your company’s inflows and outflows of cash.

And, it is VERY important to monitor your company’s cash gap and its components across multiple periods. Because your company’s cash is at stake, as a business owner, you certainly want to know how and why this critical part of your business is changing over time and take appropriate action when required.

How to Improve Your Cash Cap

A forward-thinking financial manager will try to minimize the company’s cash gap when all other things are held constant. When effectively managed, reducing the cash gap can have a positive influence on profitability and cash flow, and provide money that can be used elsewhere in the business.

A reduction in the gap can be accomplished by one or more of the following:

Improve Inventory Turnover and Management

Shortening the amount of time inventory sits idle reduces the cash gap. This is why companies are constantly seeking to improve manufacturing processes and reduce inventory—but there is a tipping point. Too little inventory could result in lost sales, forcing your customers to go to your competition if you can’t meet their product needs.

Beware of Aging Accounts Receivable

Collecting accounts receivable faster reduces the amount of time that cash will be outstanding. But beware of an aging accounts receivable. Make sure payment is made not much beyond the due date. Your credit terms may be an important part of the customer’s decision to purchase from you.

Pay Suppliers More Slowly

Stretching your payment terms with vendors will reduce the total time that your cash is outstanding. But beware of the risks of paying suppliers too slowly. They may increase prices to compensate for your slow payments, or decide to stop selling to you altogether.

What About a Negative Cash Gap?

Some companies are able to operate with a negative cash gap. This means that the company collects cash from customers before they have to pay their suppliers.

This condition is often found in consumer goods industries where cash is usually collected at the time of the sale. Companies like Amazon, Dell, and Walmart have been very successful at using the negative cash gap to their advantage. They collect their money at the time that the sale is made, and often stretch out their payables for 60 or even 90 days.

A negative cash gap can be a very positive thing, depending on the company and/or industry. A negative cash gap can be good for profitability because the company probably doesn’t need to borrow as much money to finance the shortfall.

However, beware of the cautions above in relation to how you operate your business. A negative cash gap may or may not be a realistic expectation for your business.

What Is the Best Cash Gap to Have?

As is the case with many financial metrics, the best answer is highly dependent on a number of factors. The best cash gap for any given company is a careful balance of company strategy, industry, profitability, and operational management.

Achieving the best balance for your company begins with understanding your business’ current state and identifying opportunities for improvement. That is why, as mentioned above and as with many business key performance indicators (KPIs), it’s important to not only measure the company’s performance but to track it over time.

Think: Is your Cash Gap increasing or shrinking? Did the change occur because of something that you did, or is it just moving around on its own? Your company’s money must be actively managed, and not left to arbitrary changes in your business’ marketplace.

Read on for 12 cash flow solutions if you’re cash short.

Related Posts

Cash Flow Solutions –

Twelve Things To Do If You’re Cash Short

Every business ends up short of cash from time to time. But there’s short of cash, and then there’s SHORT

Protecting Your Law Firm

As we’ve worked increasingly with law firms over the past few years, there are a number of commonalities that we’ve

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.