Four Ways That Financial Complexity Creeps Into Your Business

Author: Larry Chester, President

Small businesses have very simple financial profiles. There are:

- Few employees

- Few products

- And simple production processes

Moreover, in family-owned businesses, the family may be the only employees. In this case, the time they spend working may not be valued, because it’s “free.”

The immediate concerns are the cost of raw materials, packaging, and freight. Even a part-time controller would help; but for now, there is no one to guide the record-keeping, or provide the business metrics to help with an analysis of profitability, cash flow, or forecasting.

Detailed record-keeping is something you’ll likely take care of later. There are “more important things” to deal with now, like customers and product development!

However, before you decide to put off detailed accounting until later, below are some tips on why you should start doing that work right now.

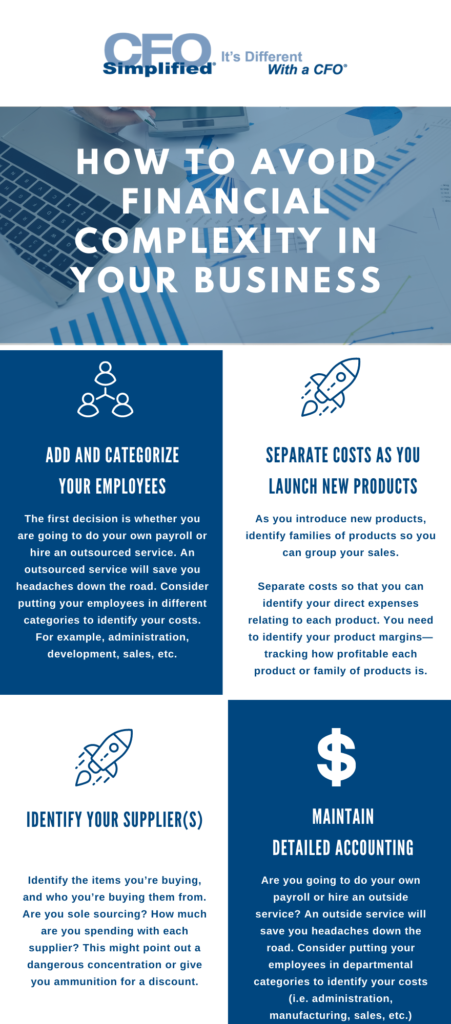

How You Can Avoid Financial Complexity

Below are four tips on how to avoid financial complexity in your business.

Add and Categorize Your Employees

The first decision is whether you are going to do your own payroll or hire an outside service. An outside service will save you headaches down the road. Consider putting your employees in departmental categories to identify your costs. For example, administration, manufacturing, sales, etc.

Separate Costs as You Launch New Products

As you introduce new products, identify families of products so you can group your sales.

Separate your costs so that you can identify your direct expenses relating to each product. You need to identify your product margins—tracking how profitable each product or family of products is.

Identify Your Supplier(s)

Identify the items you’re buying, and who you’re buying them from. Are you sole sourcing? How much are you spending with each supplier? This might point out a dangerous concentration or give you ammunition for a discount.

Maintain Detailed Accounting When It Comes to Borrowing Money

If you are going to a bank or planning an equity offering, you need to have a clear presentation of your:

- Costs and margins

- Projected sales

- And profits

All of this will be a logical extension of a detailed accounting record. Without that record, you can’t tell an accurate story of your company’s performance and future.

A Final Word on Financial Complexity

Financial complexity arrives slowly. The best time to create the financial structure for your company is right now. Implementing proper financial reporting at the outset will make your life easier.

The help of a fractional or part-time CFO or other consulting advisor provides you with the guidance to do it right, and information in your hands to make the right decisions for your future.

To learn more, read on to hear about the future of fractional CFOs.

Related Posts

Cash Flow Solutions –

Twelve Things To Do If You’re Cash Short

Every business ends up short of cash from time to time. But there’s short of cash, and then there’s SHORT

Protecting Your Law Firm

As we’ve worked increasingly with law firms over the past few years, there are a number of commonalities that we’ve

Get Clarity On Your

Company’s Performance

Our people are unique CFOs. They are all operationally

based financial executives.